5 EASY STEPS TOWARD CRAFTING AN EFFECTIVE BUDGET

Establishing a budget is the first step toward achieving a healthy financial lifestyle. You may already plan out a few expenses here and there, but the smartest way to ensure you’re making the most of your money is by following a budget based on your specific income and daily needs.

If you’ve never attempted to make a budget before, it might seem a little overwhelming. Don’t worry—here is a step-by-step guide for creating a plan that can help set you up for financial success.

1. START WITH YOUR NET INCOME

No bells and whistles here. What are you working with each month after taxes? This is where your budget will begin.

2. RECOGNIZE YOUR REGULAR EXPENSES

Be sure to include everything. Overlooking the Netflix bill or underestimating how much you pay in electricity each month can throw a kink in your plan to become a lean, mean financial machine.

3. SET A SAVINGS GOAL

It’s always a best practice to treat saving as an expense. The payday rush often leads to impulse purchases, so be sure to set your savings aside before looking at new shoes.

4. BE REALISTIC

Recognizing how much you should be saving and spending in certain areas will save you a headache down the line. If you end up over budgeting in certain areas, that just means you have more to spend later.

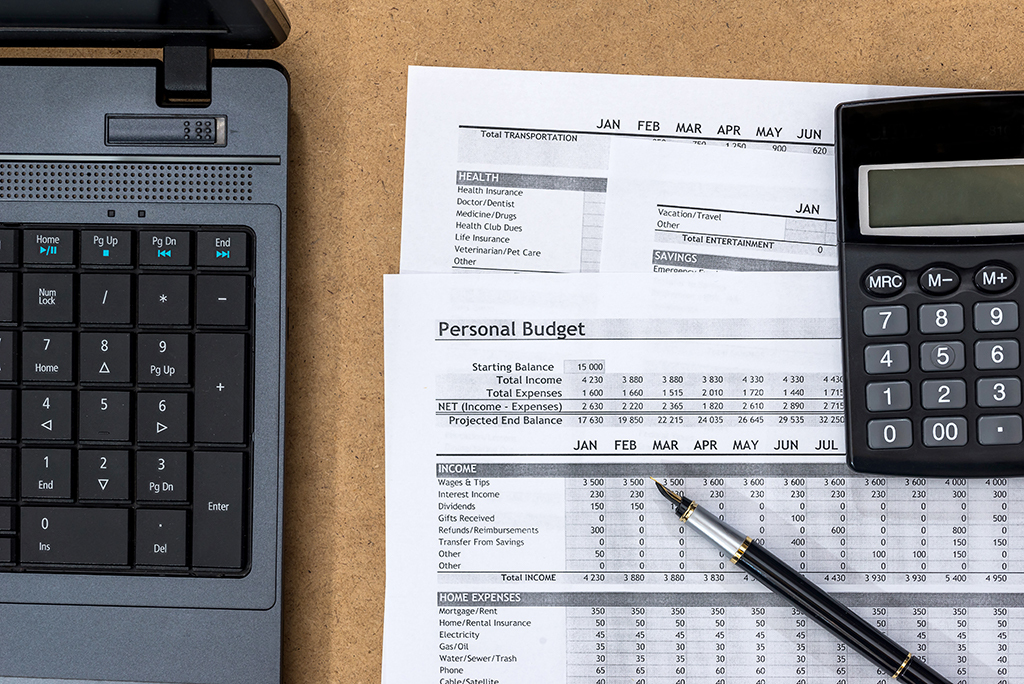

5. TRACK YOUR SPENDING

Whether you use a spreadsheet or keep things old-school with pen and paper, it’s essential to know how much you’re spending in each area of your budget. Failing to properly record what you spent and where you spent it makes for a bigger mess.

Creating your budget is only half the battle. The hard work is sticking to your plan no matter what. Know that the benefits will come in the long run. Although this may sound like a lecture from your cheap dad, well, sometimes dad knows what he’s talking about. However, unlike your dad, we’re not upset you didn’t make the varsity basketball team. The coach was totally playing favorites.